35+ 40000 deposit how much can i borrow

Our high-value personal savings accounts Money Market accounts and Individual Retirement Accounts can build a foundation for a bright financial future. Union Bank of India.

Search Referral Links Spend

Get prequalified for the best personal loan rate for you.

. State Bank of India. At a rate of 5 thats 1600 per fortnight over 30 years. Theres a Mobilization LoanLine option and no.

For example lets imagine you bought your home through Right to Buy. The APR starts at 18 and can be as high as 3599. For senior citizens or those who are of the age of 60 years and above the TDS exemption limit has been set.

Plus manage your accounts from anywhere with 247 access to the LendingClub Mobile app where you can deposit checks pay bills and utilize our personal financial management tools. If no excess reserves exist at the time this deposit is made and the reserve ratio is 20 percent Bank A can increase the money supply by a maximum of. Generally homeowners insurance costs roughly 35 per month for every 100000 of the homes value.

36 or 60 months Minimum credit score. Origination fees can either be a flat fee ranging from 25 to 500 or a percentage of the loan youve taken out ranging from 1 to 10. The initial loan principal would equal 160000.

Loans from more than 35 financial institutions. 1000 40000 Loan length. Competitive fixed rates and fixed monthly payments.

598 to 3589. 830 to 3600. Line amounts available from 10000.

For example say you put 40000 down on a 200000 mortgage. Actual APR will vary depending on credit qualifications line amount property state lien position and loan-to-value LTV ratio. Theres no limit on how much you can borrow.

Banks in the country borrow money from the Reserve Bank of India. Your mortgage results will land in. Borrow up to 40000.

This lender offers a quick turnaround time for consumers with borrowers receiving their funds within 24 hours of loan approval. See how much you can borrow. If you dont enroll in autopay interest rates range from 599 to 2449.

You can edit the calculators. Automatic payments from an eligible Fifth Third deposit account through Auto BillPayer TM are required to receive the 025 discount reflected in the lowest advertised rate. 35 of Personal Loans issued by LendingClub Bank were funded within 24 hours after loan approval.

You can get a personal loan up to 40000 that you can use for pretty much anything like paying down credit cards consolidating debt. 1000 to 40000 Regular APR. You can join by opening a savings account with a 5 minimum deposit.

Deposit amount Your borrowing. Why would you need to borrow 1m for what sounds like a first home. Consult your insurance carrier for the exact cost.

The interest rate at which the money is borrowed is known as the Repo Rate. If you made monthly mortgage payments of 859 for a year the remaining loan principal would equal 149692 and the total equity on. Surely something around 800k for a first home less 20 deposit - so borrowing of 640k.

You should be rewarded when you make a smart move and deposit money in your Florida Credit Union accounts. This depends on how much you want to borrow what APR you get from your. LendingClub loans start at just 1000 although this lender does charge origination fees.

So if your property has increased in value since the time you bought it this will impact home much you need to repay. 704 3589 Loan amount. Electronic deposit will be the fastest way to get funds.

A fixed deposit can be closed before its maturity term. Use our personal loans marketplace to get a loan for debt consolidation major purchases and more. 3 or 5 years.

To qualify you need to have a Wells Fargo checking account and make automatic payments from a Wells Fargo deposit account. Assume Company X deposits 100000 in cash in commercial Bank A. How much can I afford to borrow.

On a property valued at 120000. It was valued at 100000 at the time and you got a 40 discount 40000 meaning you. The time it takes for a loan to be funded is not guaranteed and individual results vary based on multiple factors including but not limited to.

With the ability to choose a loan amount of up to 40000 LendingClub offers fixed rates and a monthly repayment plan to fit within your budget. 3 or 5 years. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income.

Plus full QA incl full info on stamp duty holiday up to 500000. Banks will deduct tax at source TDS at 10 per cent from FD interest paidcredited if the interest from all the deposits held by the person in the bank across all branches exceeds Rs 40000 in a financial year as per current tax law. Plus our great rates on Interest Checking can make your current operating funds.

Not specified Why we like it. In case you close your. How salary deposit affect how much you can get.

Flight school financial aid to consider before borrowing. Rates and can borrow. Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and a 025 direct deposit discount.

Remember to only borrow what you need and can reasonably repay.

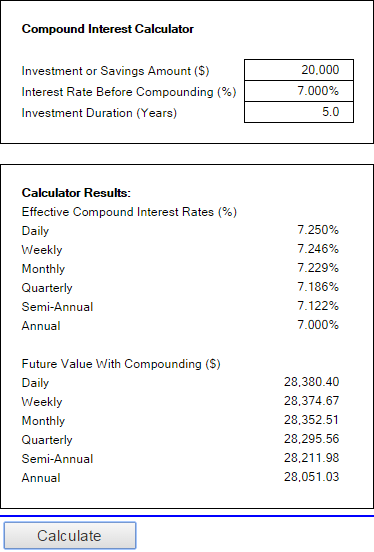

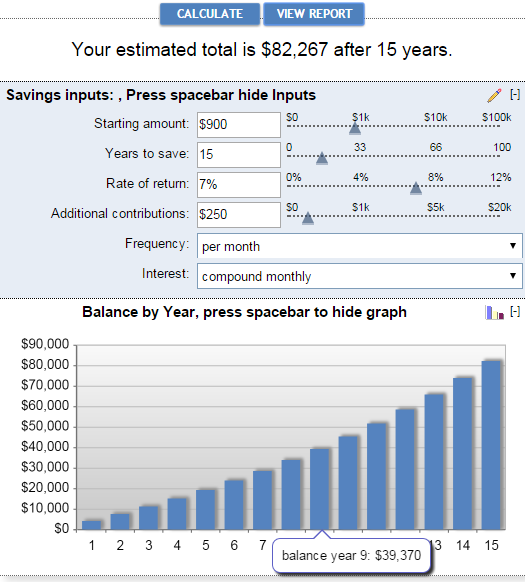

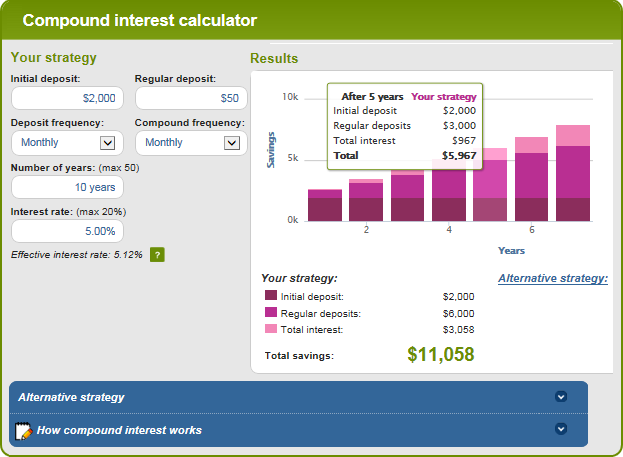

Compound Interest Formula And Calculator For Excel

2

2

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

3

1

Compound Interest Formula And Calculator For Excel

If I Take An Education Loan Amount Of Inr 20 Lakhs At An Interest Rate Of 8 9 For 7 Years What Will Be The Best Way To Repay The Loan Quora

Search Referral Links Spend

Search Referral Links Spend

All Intermediate Pdf Debits And Credits Bad Debt

3

Compound Interest Formula And Calculator For Excel

Search Referral Links Spend

1